Press Release

|July 25,2025Measured Pace of Price Growth and Sensitive Pricing by Developers to Benefit Homebuyers; Resilient HDB Resale Demand Supported Resale Flat Prices in Q2 2025

Share this article:

25 July 2025, Singapore - Private home prices saw measured growth in Q2 2025 amid fewer project launches, while HDB resale flat prices saw the slowest quarterly increase since Q2 2020, according to latest statistics from the Urban Redevelopment Authority (URA) and the Housing and Development Board (HDB).

Q2 2025 URA Private Residential Property Index

Prices of private residential property climbed by 1.0% QOQ in Q2 2025, creeping up from the 0.8% QOQ growth in Q1 2025 (see Table 1). The final print is slightly higher than the flash estimates of a 0.5% QOQ growth published earlier this month. On a year-on-year basis, the overall private home prices were up by 3.4% from Q2 2024. Taken together, the URA PPI has increased by a cumulative 1.8% in the first half of 2025 (1H 2025) compared with the 2.3% growth recorded in 1H 2024.

Prices rose across all segments with the exception of non-landed private homes in the Rest of Central Region (RCR) which saw a 1.1% QOQ decline in Q2 2025 (see Table 1), reversing the 1.7% QOQ growth in the previous quarter. In other sub-markets, prices of non-landed private homes in the Core Central Region (CCR) and Outside Central Region (OCR) rose by 3.0% QOQ and 1.1% QOQ, respectively in Q2 2025. Meanwhile, landed homes posted a second straight quarter of price growth at 2.2% QOQ in the period.

Table 1: URA Private Property Price Index (PPI) Q2 2025

Price Indices | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q4 2024 | Q1 2025 | Q2 2025 |

(QOQ % Change) | (YOY % Change) | (QOQ % Change) | |||||

Overall PPI | 1.4 | 0.9 | -0.7 | 2.3 | 3.9 | 0.8 | 1.0 |

Landed | 2.6 | 1.9 | -3.4 | -0.1 | 0.9 | 0.4 | 2.2 |

Non-Landed | 1.0 | 0.6 | 0.1 | 3.0 | 4.7 | 1.0 | 0.7 |

CCR | 3.4 | -0.3 | -1.1 | 2.6 | 4.5 | 0.8 | 3.0 |

RCR | 0.3 | 1.6 | 0.8 | 3.0 | 5.8 | 1.7 | -1.1 |

OCR | 0.2 | 0.2 | 0.0 | 3.3 | 3.7 | 0.3 | 1.1 |

During the quarter, developers sold 1,212 new units (ex. EC), down by 64% from the 3,375 units transacted in Q1 2025. When compared with Q2 2024, new home sales were up by 67% from 725 units shifted a year ago. The latest sales figures take the tally for developers' sales to 4,587 units (ex. EC) in 1H 2025, more than two times the 1,889 units sold in 1H 2024.

The RCR which saw the bulk of new launches in Q2 2025 drove developers' sales, with 902 new units being transacted - slightly lower than the 945 new units sold in the RCR in the previous quarter. The top four best-selling projects in Q2 are all in the RCR: One Marina Gardens which sold 479 units; Bloomsbury Residences which moved 158 units; The Hill @ one-north which transacted 47 units; and Grand Dunman which sold 41 units, according to caveats lodged.

Meanwhile, developers' sales in the CCR came in at 44 units in Q2 2025, down by 77% QOQ and it is the lowest quarterly tally since records began in 2004. New private home sales in the OCR also fell substantially in the absence of new launches; developers sold 266 OCR units (ex. EC) compared with 2,238 units in Q1 2025.

Over in the resale private housing market, there were 3,647 units resold in Q2 2025, marking a 2.3% QOQ increase from the 3,565 units transacted in the previous quarter. Owing to the limited new launches and weaker developers' sales, the private resale transactions made up 71.1% of the total private homes sold in Q2 2025, the highest proportion in three quarters. Meanwhile, there were 269 sub-sales units transacted in the quarter, marking the lowest sub-sales in nine quarters since 243 such units were sold in Q1 2023. Still, due to the low transaction volume, sub-sales made up 5.2% of the quarter's total sales - the highest proportion in three quarters.

In the private residential leasing segment, rentals rose by 0.8% QOQ in Q2 2025, following the 0.4% QOQ increase in the previous quarter. In 1H 2025, private home rentals climbed by 1.2% cumulatively, compared with a 2.7% decline in 1H 2024. Leasing demand improved, with 21,330 private home leasing transactions in Q2 2025, rising by 2.8% from the 20,744 rental contracts done in Q1 2025, according to URA Realis data.

Mr Kelvin Fong, CEO of PropNex said:

"We continue to see price stabilisation in the private housing market in Q2 2025, which will benefit prospective buyers and investors looking to acquire a private home. By and large, buyers remain price conscious, and attractive pricing - particularly an affordable price quantum - will be the key to driving sales momentum at project launches. Indeed, we note that the starting prices at some recent and upcoming launches are competitive, with several unit options for housing budgets of $2.5 million or below, which is roughly the pricing sweet-spot for many homebuyers today. In Q2 2025, about 66% of the new non-landed private homes (ex. EC) sold were priced at under $2.5 million, while 67% of the units sold in the first two weeks of July were transacted at that price range, as per caveats lodged.

Overall private residential sales transactions in Q2 2025 were down sharply from Q1 2025 (Q2: 5,128 units vs Q1: 7,261 units ex. EC), mainly due to fewer launches during the quarter. According to URA, developers launched 1,520 new units (ex. EC) in Q2 2025, compared with 3,139 units in the previous quarter.

Table 2: Estimated new launch pipeline (ex. EC) in Q3 2025

Estimated supply pipeline for Q3 2025 | Region | Total units | Sales at launch* |

LyndenWoods | RCR | 343 | 324 |

The Robertson Opus | CCR | 348 | 160 |

UpperHouse @ Orchard Boulevard | CCR | 301 | 143 |

Canberra Crescent Residences | OCR | 376 | Yet to launch |

Promenade Peak | RCR | 596 | Yet to launch |

River Green | CCR | 524 | Yet to launch |

Springleaf Residence | OCR | 941 | Yet to launch |

Artisan 8 | RCR | 34 | Yet to launch |

Total | 3,463 | ||

We expect new home sales to rebound in Q3 in view of the pipeline of launches (see Table 2), where more than 3,400 new condos (ex. EC) may potentially come onstream. Three projects - LyndenWoods, The Robertson Opus, and UpperHouse at Orchard Boulevard - that have been launched earlier this month saw commendable sales, moving more than 620 units collectively over their launch weekends.

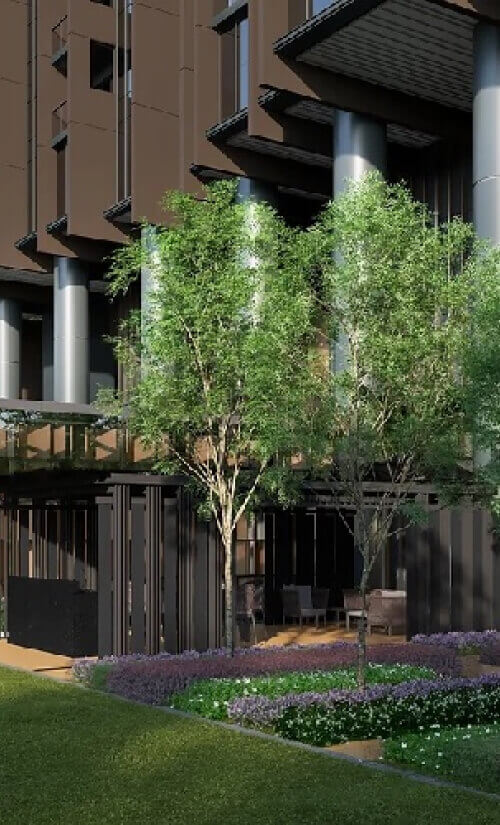

In particular, we expect developers' sales in the CCR will recover strongly in Q3 2025, propped up by the transactions at The Robertson Opus and UpperHouse at Orchard Boulevard which have sold more than 300 units combined - already topping the quarterly CCR new homes sales recorded from Q3 2023 (see Chart 1). Another CCR project, the 524-unit River Green will be launched in August.

Chart 1: New private home sales in the Core Central Region

We remain optimistic about private home sales moving forward amidst a gradual recovery in market sentiment and buying appetite, following heightened uncertainties in April after the announcement of the US Liberation Day trade tariffs. While downside risks persist, we anticipate that the sensitive pricing of homes, moderation in mortgage rates, potential wealth effect from the stock market rebound, and the still tight labour market could help to boost private housing demand. Meanwhile, the level of unsold uncompleted private homes at 18,498 units (ex. EC) as at the end of Q2 2025 remain relatively manageable, which may be absorbed by the market in less than three years, assuming an annual sales of 6,500 units.

For the whole of 2025, we expect private home prices to rise by a modest 3% to 4%, supported by resilient demand, healthy household balance sheets, easing interest rates, and an attractive pipeline of new launches. We project that new private home sales could come in at 8,000 to 9,000 units (ex. EC), while private residential resale volume may reach 14,000 to 15,000 units this year."

Q2 2025 HDB Resale Price Index

Final data released by the Housing and Development Board (HDB) showed that resale flat prices inched up by 0.9% QOQ in Q2 2025, slowing from the 1.6% QOQ increase in Q1 2025 (see Table 4). This is the third straight quarter of softer price growth, and it is the smallest quarterly price increase since Q2 2020. The final print is unchanged from the flash estimates released on 1 July. Cumulatively, the HDB resale price index has climbed by 2.5% in 1H 2025, much slower than the 4.2% growth in 1H 2024.

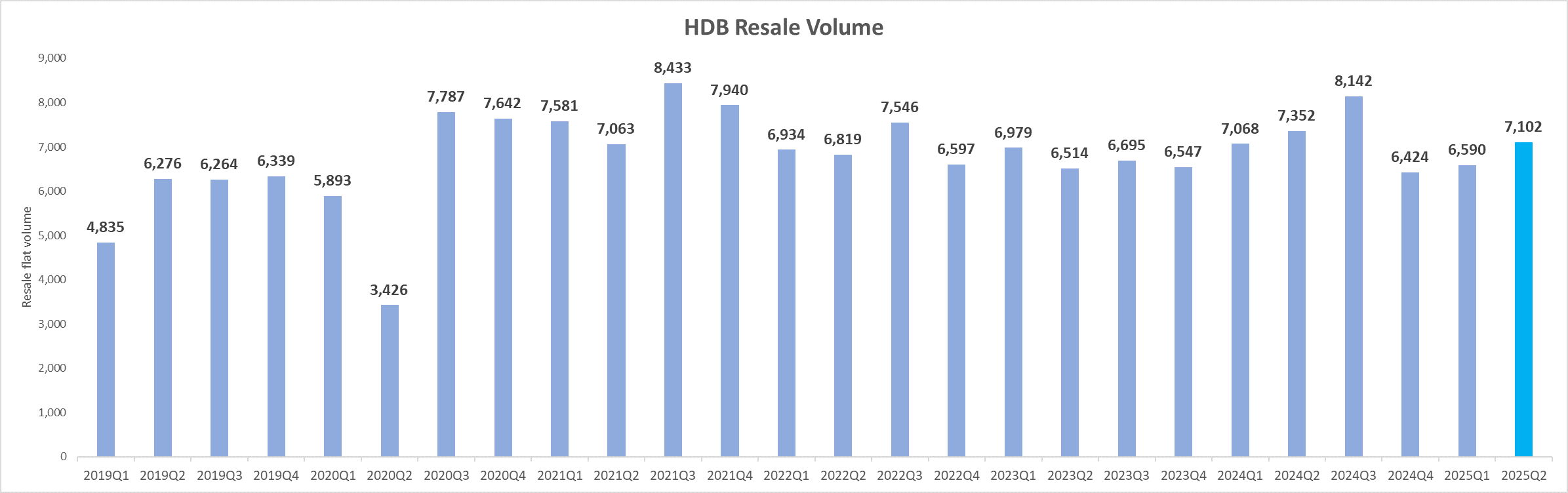

There were 7,102 HDB flats resold in Q2 2025, up by 7.8% from the 6,590 resale flats transacted in the previous quarter. On a YOY basis, the HDB resale volume was 3.4% lower than the 7,352 units sold in Q2 2024.

Table 4: HDB Resale Price Index

Quarter | QOQ % change | YOY % change |

Q1 2022 | 2.4% | 12.2% |

Q2 2022 | 2.8% | 12.0% |

Q3 2022 | 2.6% | 11.6% |

Q4 2022 | 2.3% | 10.4% |

Q1 2023 | 1.0% | 8.8% |

Q2 2023 | 1.5% | 7.5% |

Q3 2023 | 1.3% | 6.2% |

Q4 2023 | 1.1% | 4.9% |

Q1 2024 | 1.8% | 5.8% |

Q2 2024 | 2.3% | 6.6% |

Q3 2024 | 2.7% | 8.1% |

Q4 2024 | 2.6% | 9.7% |

Q1 2025 | 1.6% | 9.4% |

Q2 2025 | 0.9% | 8.0% |

Ms Wong Siew Ying, Head of Research and Content, PropNex Realty said:

"In Q2 2025, HDB resale transactions recovered while resale prices posted a slower growth trajectory. The 7,102 flats resold in Q2 2025 is the highest in three quarters (see Chart 2). This takes the total resale volume to 13,692 flats in 1H 2025, 5% lower than the 14,420 units resold in the corresponding period in 2024. Overall, we project that the HDB resale volume may range from 27,000 to 28,000 units for the whole of 2025, while HDB resale prices could climb by 4% to 5% this year - slowing from the 9.7% increase in 2024.

Chart 2: HDB resale volume

Although we expect resale flat demand to be relatively stable in the rest of the year, it is possible that the supply of new flats in the July and October Build-to-Order (BTO) exercises may potentially draw some would-be buyers from the resale market. For instance, some 870 BTO flats are expected to be launched on the former Keppel Club site in October, which are likely to be popular among many households since the project is located in the Greater Southern Waterfront precinct, close to the city. The first BTO project in Mount Pleasant which offers 1,350 flats is also set to be launched in October. Meanwhile, there are also attractive projects in the July BTO exercise in locations such as Simei, Toa Payoh, and Bukit Merah.

In terms of resale flat prices, we expect moderate price gains in the HDB resale flat segment in the second half of the year, as several factors may potentially weigh on prices. These include existing cooling measures (lowered LTV limit at 75% for HDB home loans), affordability concerns and price resistance among buyers, and competing supply in the form of new BTO flats with shorter waiting times and Sale of Balance Flats (SBF) that are either completed or close to completion. The BTO/SBF flats may appeal to buyers who want a move-in ready flat or one that can be available sooner, and may draw some attention away from the resale flat market.

That said, well-located resale flats with sought-after attributes and larger resale flats that are limited in supply may continue to see healthy demand and firm resale prices. To this end, we observe that the number of HDB flats resold for at least $1 million has remained elevated, at 415 units in Q2 2025. In 1H 2025, there were 763 units of million-dollar resale flats, and some 134 such units have already been transacted in July (data retrieved on 25 July). All in, 897 units of million-dollar resale flats have been sold, and the record 1,035 such flats resold in 2024 may be smashed as early as August or September.

According to HDB's announcement on Friday, we note that the median resale prices of 4-room flats in three towns Central Area, Queenstown, and Toa Payoh have reached at least $1 million in Q2 2025 - the first time the median price of any 4-room resale flats tipped into the million-dollar range on a quarterly basis. This is mainly due to the composition of 4-room flats resold in the quarter in those towns, as per transaction data. The last time the median resale price hit $1 million, based on HDB quarterly data, was in Q3 2022 for executive flats in Bishan ($1.045 mil).

In the Central Area, where the median resale price was $1.2 million for 4-room flats in Q2 2025, we note that 11 out of the 20 4-room resale transactions were done at the popular Pinnacle@Duxton project in the quarter, each fetching over $1 million. Meanwhile, in Queenstown (4-room median resale price: $1 million) there were 69 units of 4-room flats resold in Q2, of which 33 units are million-dollar resale deals including units that had recently reached the minimum occupation period (MOP) in Strathmore Avenue and Dawson Road. For Toa Payoh, the median resale price for 4-room flats tipped over the $1-million mark in Q2 2025, mainly propped up by transactions at recently MOP-ed projects in Bidadari Park Drive and Alkaff Crescent - about 37% of the 102 units of 4-room flats sold in Toa Payoh in Q2 had a remaining lease of more than 94 years. Sales data showed that about 51% of the 4-room flats resold in Toa Payoh in Q2 were million-dollar deals."